Pet Coke Manufacturing Plant Project Report 2025 Edition

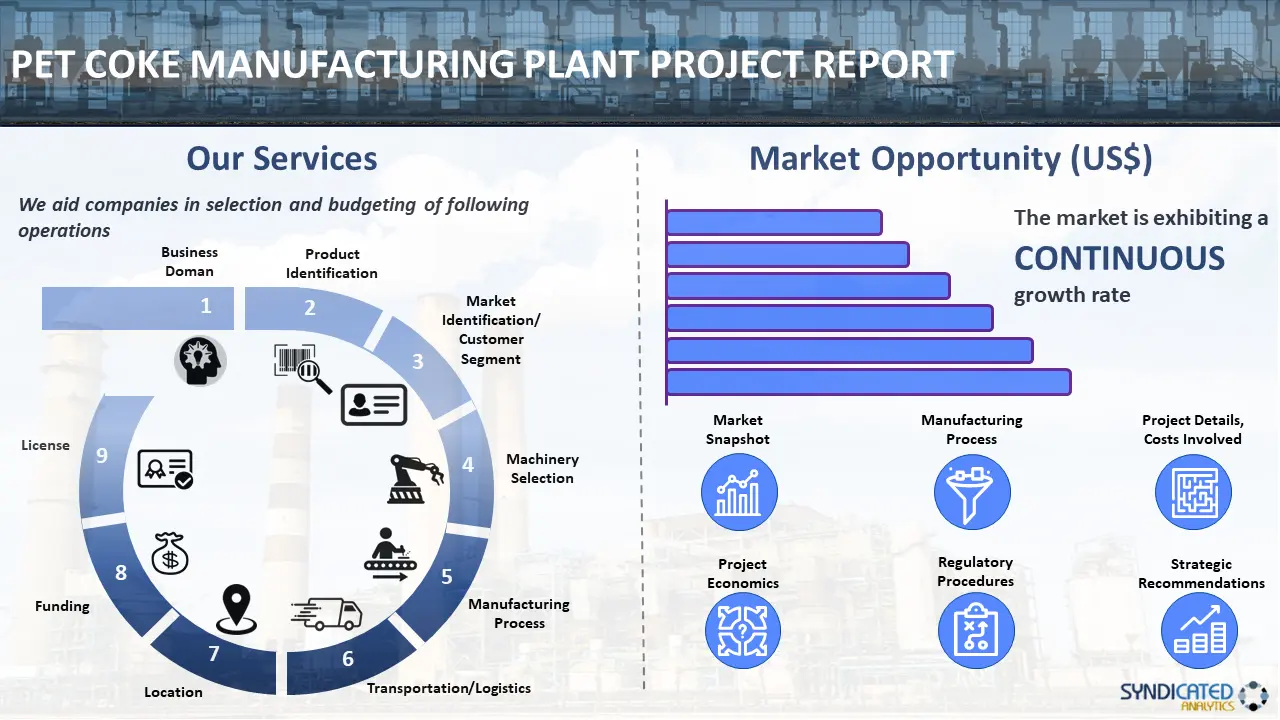

Report Coverage: Industry Analysis (Market Performance, Segments, Price Analysis, Outlook), Detailed Process Flow (Product Overview, Unit Operations, Raw Materials, Quality Assurance), Requirements and Cost (Machinery, Raw Materials, Packaging, Transportation, Utility, Human Resource), Project Economics (Capital Investments, Operating Costs, Profit Projections, Financial Analysis, Revenue), and Investment Opportunities

Report Overview:

Syndicated Analytics report, titled “Pet Coke Manufacturing Plant Project Report 2025 Edition: Industry Analysis (Market Performance, Segments, Price Analysis, Outlook), Detailed Process Flow (Product Overview, Unit Operations, Raw Materials, Quality Assurance), Requirements and Cost ( Machinery, Raw Materials, Packaging, Transportation, Utility, Human Resource), Project Economics (Capital Investments, Operating Costs, Profit Projections, Financial Analysis, Revenue), and Investment Opportunities” provides a complete roadmap for setting up a pet coke manufacturing plant. It covers a comprehensive market overview to micro-level information such as unit operations involved, raw material requirements, utility requirements, infrastructure requirements, machinery and technology requirements, manpower requirements, packaging requirements, transportation requirements, etc. The report provides detailed insights into project economics, including capital investments, project funding, operating expenses, income and expenditure projections, fixed costs vs. variable costs, direct and indirect costs, expected ROI and net present value (NPV), profit and loss account, financial analysis, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, and business strategists with a stake in the pet coke industry. It provides an in-depth analysis of the industry's current state and future potential, offering valuable insights for decision-making and strategy development. The report is an indispensable resource that offers a detailed examination of the pet coke industry. It is a valuable tool for anyone seeking to establish a foothold in this dynamic sector.

Pet coke, commonly known as petroleum coke, refers to a carbon-rich solid material derived from the oil refining process, specifically from the coker unit in refineries. It is categorized into fuel-grade and calcined coke, each suitable for varied applications. Pet coke exhibits various properties depending on the source of the crude oil and the refining process, such as high carbon content, low ash, and minimum volatile matter. It is widely used as a fuel in power plants, cement kilns, and aluminum production. Additionally, pet coke is employed in the manufacturing of steel and graphite electrodes and as a fuel for marine and other industrial boilers. It is known for its high calorific value, cost-effectiveness, abundance, and consistent quality. Moreover, pet coke provides several advantages, such as efficient energy production, adaptability to various industrial uses, reduced waste from oil refining, and its role as an alternative to coal in energy-intensive industries.

Market Trends/Drivers:

The increasing demand for energy across the globe is facilitating the demand for pet coke due to its high calorific value. Additionally, the widespread product adoption as a key raw material in aluminum production is boosting the market growth. Besides this, the rising product demand as a fuel in the construction industry for the production of cement is strengthening the market growth. Furthermore, the heightened awareness regarding the lower cost of pet coke compared to other fossil fuels, which makes it an economical choice for energy and manufacturing sectors, is supporting the market growth. In addition, the heightened product application in the steel industry, especially in electric arc furnace operations, is driving the market growth. Apart from this, the imposition of stricter regulations on coal usage for environmental concerns, which has shifted the focus towards alternative fuels like pet coke, is positively influencing the market growth. Moreover, recent innovations in refining processes, which have improved the quality of pet coke, making it more suitable for various applications, are bolstering the market growth. In addition, the expanding industrial activities across the globe, leading to higher consumption of pet coke, is acting as another growth-inducing factor. Along with this, rapid urbanization, which necessitates increased energy and building materials, is accelerating the market growth.

The project report covers the following aspects of the pet coke market:

- Market Snapshot:

- Market Performance

- Market Breakup by Segment

- Market Breakup by Region

- Price Trends

- Impact of COVID-19

- Market Outlook

- Manufacturing Process:

- Product Overview

- Detailed Process Flow

- Unit Operations Involved

- Mass Balance and Raw Material Requirements

- Project Details, Requirements and Costs Involved:

- Land, Location and Site Development

- Plant Layout

- Machinery Requirements and Expenditures

- Raw Material Requirements and Expenditures

- Packaging Requirements and Expenditures

- Transportation Requirements and Expenditures

- Utility Requirements and Expenditures

- Manpower Requirements and Expenditures

- Project Economics

- Capital Investments

- Operating Costs

- Expenditure Projections

- Revenue Projections

- Profit Projections

- Financial Analysis

- Regulatory Procedures and Approval

- Key Success and Risk Factors

Report Scope:

| Report Features | Details |

|---|---|

| Product Name | Pet Coke |

| Report Coverage | Detailed Process Flow: Unit Operations Involved, Quality Assurance Criteria, Technical Tests, Mass Balance, and Raw Material Requirements Land, Location and Site Development: Selection Criteria and Significance, Location Analysis, Project Planning and Phasing of Development, Environmental Impact, Land Requirement and Costs Plant Layout: Importance and Essentials, Layout, Factors Influencing Layout Plant Machinery: Machinery Requirements, Machinery Costs, Machinery Suppliers (Provided on Request) Raw Materials: Raw Material Requirements, Raw Material Details and Procurement, Raw Material Costs, Raw Material Suppliers (Provided on Request) Packaging: Packaging Requirements, Packaging Material Details and Procurement, Packaging Costs, Packaging Material Suppliers (Provided on Request) Other Requirements and Costs: Transportation Requirements and Costs, Utility Requirements and Costs, Energy Requirements and Costs, Water Requirements and Costs, Human Resource Requirements and Costs Project Economics: Capital Costs, Techno-Economic Parameters, Income Projections, Expenditure Projections, Product Pricing and Margins, Taxation, Depreciation Financial Analysis: Liquidity Analysis, Profitability Analysis, Payback Period, Net Present Value, Internal Rate of Return, Profit and Loss Account, Uncertainty Analysis, Sensitivity Analysis, Economic Analysis Other Analysis Covered in The Report: Market Trends and Analysis, Market Segmentation, Market Breakup by Region, Price Trends, Competitive Landscape, Regulatory Landscape, Strategic Recommendations, Case Study of a Successful Venture |

| Currency | US$ (Information can also be provided in the local currency) |

| Pricing and Purchase Options | Single User License: US$ 3450 Five User License: US$ 4450 Corporate User License: US$ 5450 |

| Customization Scope | The report can also be customized based on the requirement of the customer |

| Post-Sale Analyst Support | 12-14 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report?

- What are the key success and risk factors in the pet coke industry?

- How has the pet coke market performed so far and how will it perform in the coming years?

- What is the structure of the pet coke industry and who are the key players?

- What are the various unit operations involved in an pet coke manufacturing plant?

- What is the total size of land required for setting up an pet coke manufacturing plant?

- What are the machinery requirements for setting up an pet coke manufacturing plant?

- What are the raw material requirements for setting up an pet coke manufacturing plant?

- What are the utility requirements for setting up an pet coke manufacturing plant?

- What are the manpower requirements for setting up an pet coke manufacturing plant?

- What are the infrastructure costs for setting up an pet coke manufacturing plant?

- What are the capital costs for setting up an pet coke manufacturing plant?

- What are the operating costs for setting up an pet coke manufacturing plant?

- What should be the pricing mechanism of an pet coke?

- What will be the income and expenditures for an pet coke manufacturing plant?

- What is the time required to break-even?

Need a Customized Project Report?

Although we have tried to make the report as comprehensive as possible, we believe that every stakeholder may have their specific requirements. In view of this, we can customize the report based on your particular needs. You can share your business requirements with our consultants, and we will provide you a tailored scope. Some of the common customizations that our clients request us include:

- The report can be customized based on the country/region that you plan to set up your plant.

- The manufacturing capacity of the plant can be customized based on your requirements.

- Machinery suppliers and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why buy Syndicated Analytics reports?

-

Our reports provide stakeholders insights into the viability of a business venture, allowing them to take informed business decisions.

- We have a strong network of consultants and domain experts in 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- We have a strong database of equipment and raw material suppliers across all major continents.

- We regularly track and update land costs, construction costs, Utility costs, labour costs, etc across 100+ countries around the globe

- We are the trusted business partners to the world’s leading corporates, governments, and institutions. Our client list ranges from small and start-up businesses to fortune 500 companies

- Our strong in-house team of engineers, statisticians, modelling experts, charted accountants, architects, etc. have been instrumental in building, expanding, and optimizing sustainable manufacturing plants across the globe.

Purchase Options

Ask For Customization

Personalize this research

Triangulate with your own data

Get data as per your format and definition

Gain a deeper dive on a specific application, geography, customer or competitor

Any level of personalization

Get in Touch

Call us on

US: +1-213-316-7435

Uk: +44-20-8040-3201

Drop us an email at

sales@syndicatedanalytics.com