LPG Production Cost Analysis Report 2025 Edition: Industry Trends, Capital Investment, Price Trends, Manufacturing Process, Raw Materials Requirement, Operating Cost, and Revenue Statistics

Report Overview:

The report by Syndicated Analytics, titled “LPG Production Cost Analysis Report 2025 Edition: Industry Trends, Capital Investment, Price Trends, Manufacturing Process, Raw Materials Requirement, Operating Cost, and Revenue Statistics ,” offers a comprehensive examination of the operating costs and revenue statistics associated with establishing an LPG plant. It is the culmination of extensive primary and secondary research, encompassing a detailed analysis of market trends and the impact of COVID-19 on both global and regional levels. Additionally, it provides profiles of key industry players. The report also delves into price trends, mass balance required raw materials, and the various unit operations integral to the LPG manufacturing process. It includes a comprehensive capital cost analysis while covering the cost breakdown of raw materials, utilities, labor, packaging, transportation, land and construction, and machinery. The study also presents projected profit margins and recommends optimal product pricing strategies. For individuals contemplating entry into the LPG industry or those with vested interests, this report is an essential resource.

Liquified petroleum gas (LPG) is a flammable mixture consisting of two hydrocarbon gases: propane and butane. It is a portable, clean, non-toxic, renewable, and effective energy source commonly employed as fuel in numerous application segments. It is obtained during the manufacturing of oil and natural gas and is liquefied through pressurization. It is supplied and stored in bulk storage tanks, canisters, and cylinders for numerous household and industrial applications. Currently, LPG finds extensive applications in the chemical, automotive, and manufacturing sectors as a preferred energy source across the globe.

The global LPG market is primarily driven by increasing energy consumption due to the rise in the population and ongoing infrastructural developments. Moreover, there has been a surge in the adoption of clean energy sources by individuals owing to the rising concerns regarding carbon emissions and growing pollution levels. In line with this, the increasing traction of LPG as an alternative to fossil fuels is positively influencing market growth. Besides this, the escalating demand for LPG as an auto emission gas in the automobile industry is another major growth-inducing factor. Additionally, governments of numerous countries are taking supportive initiatives to promote the use of LPG. For instance, the launch of favorable policies and the provision of subsidies and tax benefits to suppliers to increase the LPG uptake has accelerated the product adoption rate. Along with this, the rising number of initiatives to spread awareness and educate the rural community about the benefits of replacing conventional energy sources like coal, wood, and kerosene with LPG has catalyzed market growth. Furthermore, numerous advancements in natural gas extraction and refinement technologies are contributing to market growth. Other factors, including surging investments in research and development (R&D) activities, growing environmental consciousness among consumers, rapid urbanization, rising emphasis on the use of bio-LPG, and increasing production of non-conventional gases, are also anticipated to create a favorable market outlook.

This production cost analysis report by Syndicated Analytics is the result of a comprehensive examination of the lpg manufacturing process. The study covers all the requisite aspects that one needs to know while making a foray into the lpg industry. It is based on the latest economic data and presents exhaustive insights about the primary process flow, raw material requirements, reactions involved, utility costs, operating costs, capital investments, pricing, margins, etc. This report is a must-read for entrepreneurs, investors, researchers, consultants, business strategists, and all those who have any kind of stake in the lpg industry.

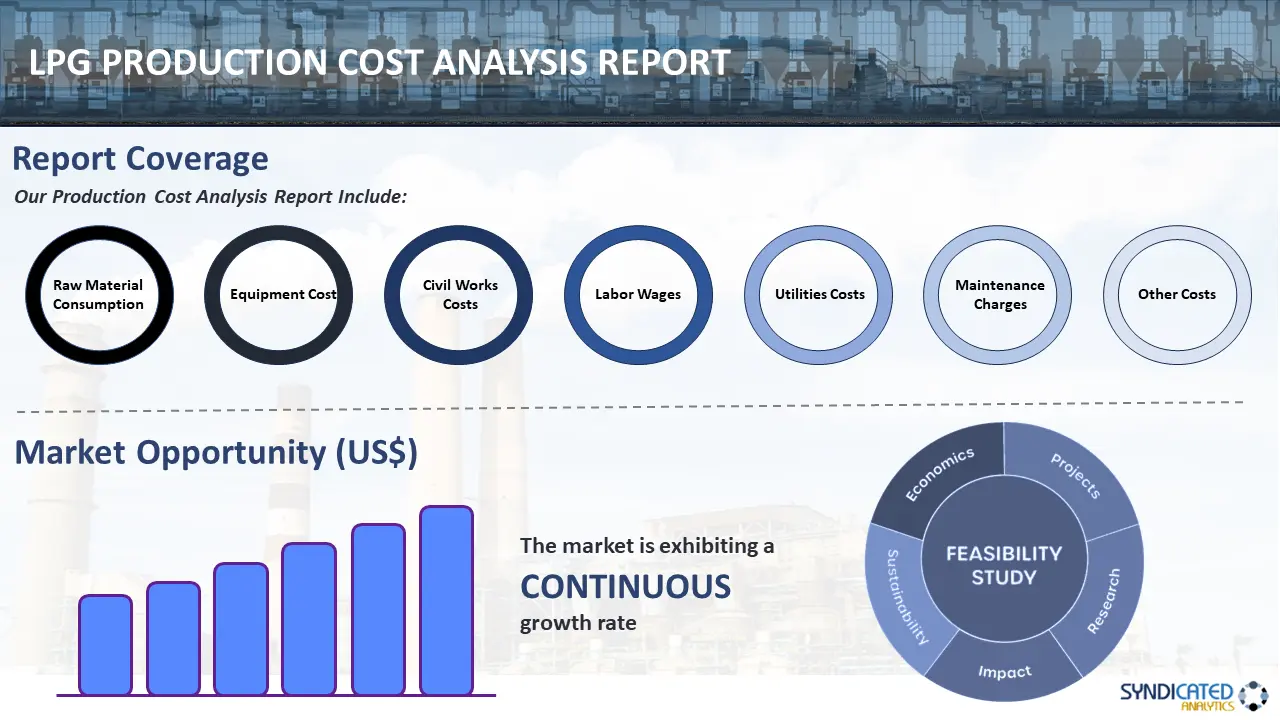

The following technical and economic aspects are included in the report:

- Market Trends

- Impact of COVID-19

- Major Regions

- Key Manufacturers

- Price Trends

- Mass Balance and Raw Material Requirements

- Various Types of Unit Operations Involved

- Raw Material Costs

- Utility Costs

- Labor Costs

- Packaging Costs

- Transportation Costs

- Land and Construction Costs

- Machinery Costs

- Profit Margins

- Product Pricing

Key Questions Answered in This Report-

- What are the various unit operations involved in manufacturing lpg?

- What are the raw material requirements and costs in manufacturing lpg?

- What are the utility requirements and costs in manufacturing lpg?

- What are the manpower requirements and costs in manufacturing lpg?

- What are the packaging requirements and costs in manufacturing lpg?

- What are the transportation requirements and costs in manufacturing lpg?

- What are the land requirements and costs in manufacturing lpg?

- What are the construction requirements and costs in manufacturing lpg?

- What are the profit margins in lpg?

- What should be the pricing mechanism of lpg?

Need a Customized Project Report?

Although we have tried to make the report as comprehensive as possible, we believe that every stakeholder may have their specific requirements. In view of this, we can customize the report based on your particular needs. You can share your business requirements with our consultants, and we will provide you a tailored scope. Some of the common customizations that our clients request us include:

- The report can be customized based on the country/region that you plan to set up your plant.

- The manufacturing capacity of the plant can be customized based on your requirements.

- Machinery suppliers and costs can be customized based on your requirements.

- Any additions to the current scope can also be provided based on your requirements.

Why buy Syndicated Analytics reports

- Our reports provide stakeholders insights into the viability of a business venture, allowing them to make informed business decisions.

- We have a strong network of consultants and domain experts in 100+ countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- We have a strong database of equipment and raw material suppliers across all major continents.

- We regularly track and update land costs, construction costs, utility costs, labor costs, etc. across 100+ countries around the globe.

- We are the trusted business partners of the world’s leading corporates, governments, and institutions. Our client list ranges from small and start-up businesses to Fortune 500 companies.

- Our strong in-house team of engineers, statisticians, modeling experts, charted accountants, architects, etc. have been instrumental in building, expanding, and optimizing sustainable manufacturing plants across the globe.

Purchase Options

Ask For Customization

Personalize this research

Triangulate with your own data

Get data as per your format and definition

Gain a deeper dive on a specific application, geography, customer or competitor

Any level of personalization

Get in Touch

Call us on

US: +1-213-316-7435

Uk: +44-20-8040-3201

Drop us an email at

sales@syndicatedanalytics.com