Lithium Battery Materials Manufacturing Plant Project Report 2025 Edition

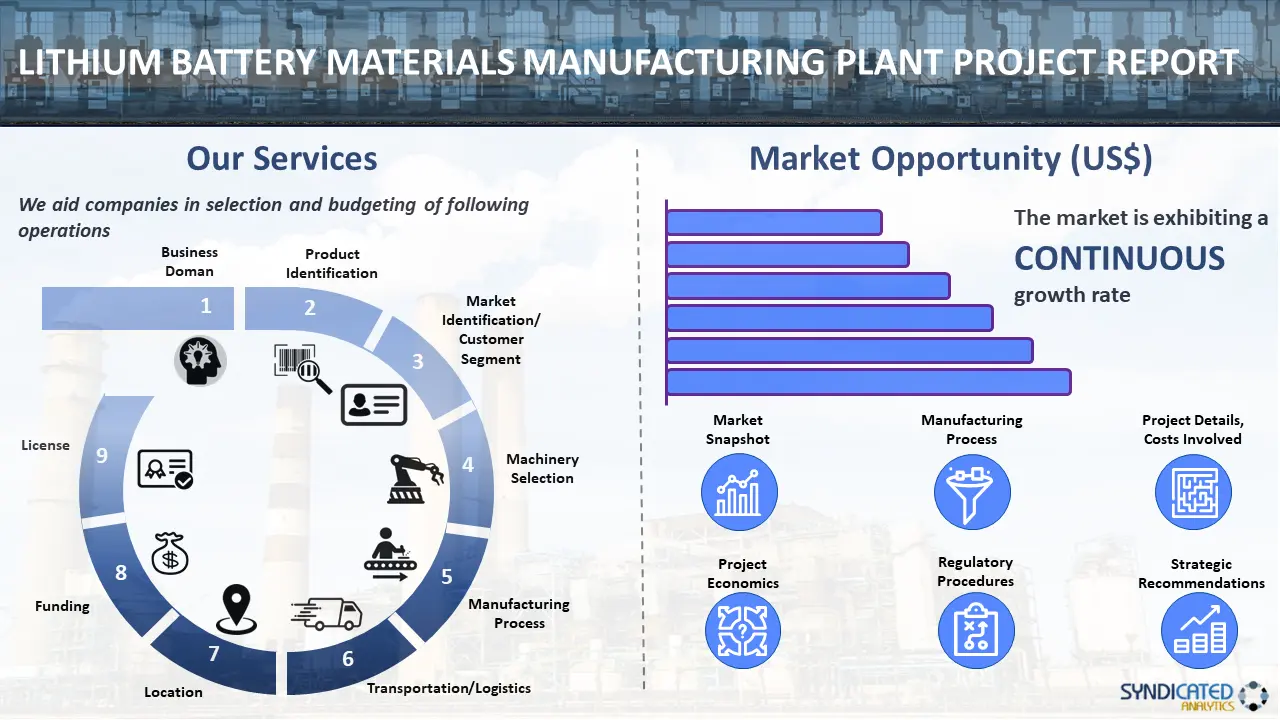

Report Coverage: Industry Analysis (Market Performance, Segments, Price Analysis, Outlook), Detailed Process Flow (Product Overview, Unit Operations, Raw Materials, Quality Assurance), Requirements and Cost (Machinery, Raw Materials, Packaging, Transportation, Utility, Human Resource), Project Economics (Capital Investments, Operating Costs, Profit Projections, Financial Analysis, Revenue), and Investment Opportunities

Report Overview:

The new report conducted by Syndicated Analytics, titled “Lithium Battery Materials Manufacturing Plant Project Report 2025 Edition: Industry Analysis (Market Performance, Segments, Price Analysis, Outlook), Detailed Process Flow (Product Overview, Unit Operations, Raw Materials, Quality Assurance), Requirements and Cost (Machinery, Raw Materials, Packaging, Transportation, Utility, Human Resource), Project Economics (Capital Investments, Operating Costs, Profit Projections, Financial Analysis, Revenue), and Investment Opportunities ,” offers a comprehensive guide for establishing a manufacturing plant in the lithium battery materials industry. It encompasses a wide-ranging market overview and delves into specific details such as unit operations, raw material requirements, utility needs, infrastructure prerequisites, machinery and technology specifications, workforce demands, packaging prerequisites, transportation logistics, and more.

Furthermore, this report delivers extensive insights into project economics, including capital investments, project financing, operating costs, income and expenditure forecasts, fixed versus variable expenses, direct and indirect outlays, expected return on investment (ROI), net present value (NPV), profit and loss analysis, and comprehensive financial assessment.

Market Analysis

| Current Demand for Lithium Battery Materials | The report evaluates the existing global demand for lithium battery materials. |

| Growth Prospects and Trends | The study delves into the growth prospects and emerging trends within the lithium battery materials market, providing insights to guide strategic decision-making. |

| Leading Segment and Regional Analysis | This study presents a concise overview of the key segments and regional influence in the lithium battery materials market, providing a comprehensive view of the industry's overall landscape. |

| Competitive Landscape | An analysis of the competitive landscape highlights key players in the lithium battery materials manufacturing industry, shedding light on their strategies and market positioning. |

Lithium Battery Materials Market Overview:

The market for lithium battery materials is shaped by a number of variables, including the growth of industries like electric vehicles (EVs), consumer electronics, and renewable energy storage systems. The availability and cost of raw materials, such as lithium, cobalt, nickel, and graphite are crucial drivers. Simultaneously, several governments are promoting the usage of cleaner energy technologies through subsidies and regulations. Policies that encourage the adoption of electric vehicles or renewable energy installations directly boost the market for lithium batteries and their constituent materials. For example, under the terms of their ten-year contract, Umicore will provide high-nickel battery materials to AESC's US facilities so they may produce electric vehicles. The deal, which runs from 2026 to 2035, also emphasizes Umicore's leadership in creating high-performance cathode materials for next-generation batteries and its dedication to constructing a carbon-neutral battery materials plant in Ontario, Canada.

Lithium Battery Materials Market Trends:

Advancements in Battery Technology

Technological advancements that boost the efficiency, capacity, and safety of lithium batteries can expand their applications and market demand. Innovations in materials, including cathodes, anodes, and electrolytes contribute to better battery performance, propelling further adoption. Besides this, the inflating investments in R&D lead to new and improved materials that offer better performance or reduce costs. Furthermore, developments in nickel-rich cathodes and silicon-based anodes are notable, as they aim to enhance energy density and battery life. For example, POSCO Future M and General Motors expanded their Ultium CAM joint venture in North America by increasing Cathode Active Material (CAM) production and adding Precursor CAM (pCAM) capacity; completion is expected by 2026.

Growth in Electric Vehicles

The market for lithium battery materials is mainly influenced by the growing demand for electric vehicles. The demand for high-capacity lithium batteries and the materials used to create them is rising as automakers ramp up production of electric vehicles (EVs) in response to government requirements and public demand for more environmentally friendly alternatives to fossil fuels. Furthermore, global government regulations are placing a greater emphasis on cutting carbon emissions, which promotes the creation and application of sophisticated lithium batteries across various industries. For instance, several countries have announced plans to ban the sales of ICE vehicles in the future. Norway announced plans to ban the sales of ICE vehicles by 2025, France by 2040, and the United Kingdom by 2050. India also has plans to phase out ICE engines by 2030, while China's similar plan is under the relevant research phase.

Latest Industry News:

- Umicore and AESC signed a ten-year agreement for Umicore to supply high-nickel battery materials for EV production at AESC's US facilities. Running from 2026 to 2035, the agreement also underscores Umicore's commitment to building a carbon-neutral battery materials plant in Ontario, Canada, and highlights its leadership in developing high-performance cathode materials for next-generation batteries.

- BASF SE partnered with Nanotech Energy to produce lithium battery materials in North America with locally recycled content and a low CO2 footprint. The agreement will enable BASF SE to provide cathode active materials produced with recycled metals on a commercial scale in North America, with support from American Battery Technology Company.

This report is essential reading for entrepreneurs, investors, researchers, consultants, and business strategists with interests in the lithium battery materials industry. It offers a thorough examination of the current state of the industry and its future potential, supplying valuable information for informed decision-making and strategic planning. Serving as an invaluable resource, this report provides a detailed exploration of the lithium battery materials industry, making it an indispensable tool for those looking to establish a strong presence in this dynamic sector.

Market Coverage:

| Current Demand for Lithium Battery Materials | The report evaluates the existing global demand for lithium battery materials. |

| Growth Prospects and Trends | The study delves into the growth prospects and emerging trends within the lithium battery materials market, providing insights to guide strategic decision-making. |

| Leading Segment and Regional Analysis | This study presents a concise overview of the key segments and regional influence in the lithium battery materials market, providing a comprehensive view of the industry's overall landscape. |

| Competitive Landscape | An analysis of the competitive landscape highlights key players in the lithium battery materials manufacturing industry, shedding light on their strategies and market positioning. |

Project Feasibility

| Technical Feasibility | The study outlines the intricacies of lithium battery materials manufacturing plant, outlining the necessary equipment and technological requirements. A clear description of the manufacturing process is provided. |

| Financial Feasibility | The report presents an in-depth financial analysis, including the initial investment required, income and profit projections. These financial insights aim to assist potential investors in assessing the viability of the project. |

| Environmental and Regulatory Considerations | The report also discusses the environmental and regulatory aspects associated with lithium battery materials production, ensuring that the project aligns with sustainability and compliance standards. |

Project Implementation

| Location Selection | Choosing the optimal location for the lithium battery materials manufacturing plant is crucial. This section explores location-based factors impacting the project's success. |

| Plant Design and Layout | Detailed plant design and layout plans are presented, emphasizing efficient production processes and workspace ergonomics. |

| Procurement of Raw Materials | An overview of the procurement process for raw materials necessary for lithium battery materials production is provided, ensuring a smooth supply chain. |

| Production Process | An explanation of the lithium battery materials production process is provided in the study, from raw material input to the final product, highlighting key stages and quality control measures. |

| Quality Control Measures | Stringent quality control measures are outlined to ensure the production of high-quality lithium battery materials. |

Risk Analysis

| Identification of Potential Risks | Potential risks associated with the project are identified, allowing for proactive risk management strategies. |

| Risk Mitigation Strategies | The report proposes risk mitigation strategies to minimize the impact of identified risks on the project's success. |

Seeking a Tailored Project Report?

While we have endeavored to create a comprehensive report, we acknowledge that each stakeholder may possess unique requirements. In light of this, we offer the option to customize the report to align with your specific needs. You can convey your business specifications to our consultants, and we will furnish you with a personalized scope tailored precisely to your requirements. Some of the common customizations that our clients often request include:

- Tailoring the report to suit the country/region where you intend to establish your lithium battery materials manufacturing plant.

- Adapting the manufacturing capacity of the plant to meet your specific needs.

- Customizing machinery suppliers and costs to align with your requirements.

- Incorporating any additional elements into the existing scope as per your specifications.

Report Scope:

| Features | Details |

|---|---|

| Currency | US$ (Information can also be provided in the local currency) |

| Pricing and Purchase Options | Single User License: US$ 3450 Five User License: US$ 4450 Corporate User License: US$ 5450 |

| Customization Scope | The lithium battery materials manufacturing plant project report can also be customized based on the requirements of the customer. |

| Post-Sale Analyst Support | 12-14 Weeks |

| Delivery Format | PDF and Excel through email (We can also provide the editable version of the report in PPT/Word format on special request) |

Questions Addressed in the Report:

- What has been the performance of the lithium battery materials market to date, and what are the projections for its future growth?

- How is the lithium battery materials market segmented globally?

- How is the lithium battery materials market distributed across various regions?

- What trends are observed in the pricing of different feedstocks within the lithium battery materials industry?

- What constitutes the structure of the lithium battery materials industry, and who are its major stakeholders?

- What key operations are necessary for manufacturing lithium battery materials?

- How much land is required to establish a lithium battery materials manufacturing plant?

- What is the planned layout for a lithium battery materials manufacturing plant?

- What equipment is essential for starting a lithium battery materials manufacturing plant?

- What materials are needed to begin production in a lithium battery materials manufacturing plant?

- What are the packaging necessities for a lithium battery materials manufacturing plant?

- What transportation logistics are required for a lithium battery materials manufacturing plant?

- What utilities are needed to operate a lithium battery materials manufacturing plant?

- What staffing is necessary for the operation of a lithium battery materials manufacturing plant?

- What are the estimated infrastructure costs for establishing a lithium battery materials manufacturing plant?

- What initial investments are necessary for setting up a lithium battery materials manufacturing plant?

- What will the ongoing operational expenses be for a lithium battery materials manufacturing plant?

- How should be the pricing structure for the final product in the lithium battery materials industry?

- What are the expected revenues and costs associated with running a lithium battery materials manufacturing plant?

- How long will it take for the plant to reach the break-even point?

- What are the forecasted profits from establishing a lithium battery materials manufacturing plant?

- What factors determine success and what risks exist in the lithium battery materials industry?

- What regulations must be complied with to establish a lithium battery materials manufacturing plant?

- What certifications are necessary to operate a lithium battery materials manufacturing plant?

Why Choose Syndicated Analytics:

- Our reports offer valuable insights to stakeholders, enabling them to make informed business decisions confidently.

- We maintain a robust network of consultants and domain experts spanning over 100 countries across North America, Europe, Asia Pacific, South America, Africa, and the Middle East.

- Our extensive database includes equipment, and raw material suppliers from major continents, ensuring comprehensive coverage.

- We diligently track and update critical factors such as land costs, raw material costs, construction costs, utility expenses, labor costs, and more, across more than 100 countries worldwide.

- Syndicated Analytics is the trusted partner of choice for leading corporations, governments, and institutions globally. Our clientele ranges from small startups to Fortune 500 companies.

- Our dedicated in-house team comprises experts in various fields, including engineers, statisticians, modeling specialists, chartered accountants, architects, and more. They play a pivotal role in developing, expanding, and optimizing sustainable manufacturing facilities worldwide.

Purchase Options

Ask For Customization

Personalize this research

Triangulate with your own data

Get data as per your format and definition

Gain a deeper dive on a specific application, geography, customer or competitor

Any level of personalization

Get in Touch

Call us on

US: +1-213-316-7435

Uk: +44-20-8040-3201

Drop us an email at

sales@syndicatedanalytics.com